How We Use LTV

Understanding LTV (Loan-to-Value Ratio)

At Clear to Close Capital™, we believe in clarity and transparency — and that starts with understanding how your loan amount is determined.

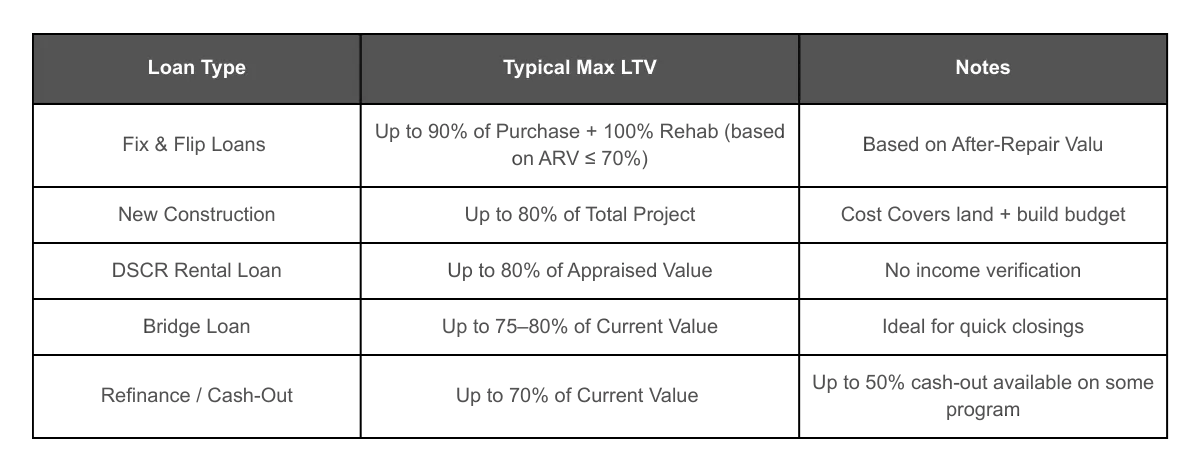

LTV (Loan-to-Value Ratio) measures the relationship between the loan amount and the value of the property (either purchase price or after-repair value, depending on the program).

Different loan programs have different LTV limits based on the type of project, risk, and experience level.

Why It Matters

Higher LTV = More Leverage. You keep more of your cash for materials, reserves, and growth.

Lower LTV = Lower Risk. Sometimes strategic equity leads to faster approvals and better terms.

Balanced LTV = Faster Funding. We find the sweet spot that gets your deal approved and clear to close quickly.

Our Commitment: Fair LTV, Fast Funding

We evaluate every project individually — not just by numbers on paper.

If your deal makes sense, we’ll find a way to make it work.

Up to 90% Financing Available

State-Specific 100% Funding Programs

No Credit or Appraisal Options Available